DEAR HDB OWNERS,

Have YOU Taken Advantage Of This Opportunity???

With my diligent Financial Solution and detailed Asset Progression Plan, you, too, can achieve Financial Success Easily.

If you've had a HDB for more than 5 years and have a combined income of $7K, you may be qualified...

Have a sizable reserve fund of up to $120,000.

Have you ever wondered why so many families with a household income of $7K or more can afford a condominium?

How did this HAPPEN !!!

LET’S MEET FOR A FREE DISCUSSION TODAY!

Through this NON-OBLIGATORY sharing…

You'll discover how to Build PASSIVE INCOME with little or no additional financial effort, as well as how to put together a solid savings plan for yourself and your family.

g couple in love walking in the park holding hands

Case Study 1

Mr and Mrs Tan, both 35 yrs old with a combined household income of $7280, were owners of a 4 room HDB flat.

Initially, they called and met me for assisting them to sell their current house and plan to upgrade to a bigger flat.

However, through my implementation of in-depth financial calculations and strategic plans, they discovered a better way to grow their wealth.

step 1: The planning

They have a great choice to optimize their financial capability for a much BETTER RETURN in terms of wealth and eventual retirement plan thanks to the analysis and detailed financial calculations.

STEP 2: The results

They've since upgraded to a Condo WITHOUT using their savings, and they also have a $150,000 cash reserve.

They are also considering investing in a second property next year because they have a clear wealth progression road map.

How did they achieve it ?

Case Study 2

Mr and Mrs Lee, both 40 yrs old, owned a HDB 5 rooms flat at Mei Ling Street. They intend to upgrade to a 3 bedrooms resale condo so that their young children can enjoy the condo facilities.

They were also looking for passive income possibilities.

Mr and Mrs Lee own a HDB 5 rooms flat, estimated marketable price of their HDB is $750,000.

* Both Age : 40 with the monthly salary of $6000 and $5000 respectively

* Currently Total CPF OA available $115,000

* Outstanding HDB loan is $200,000

* Total CPF used + incurred interest $360,000

* Both of them don’t have cash saving.

1) Possible Mr and Mrs Lee own 2 properties which is one for own stay and one for investment?

2) What are the options available for them to reduce the ABSD?

Yes, They ACHIEVED their Goals yet Save up to $135,000.

They found a better way to progress their assets thanks to my introduction of in-depth financial calculations and strategic plans.

How did they achieve it ?

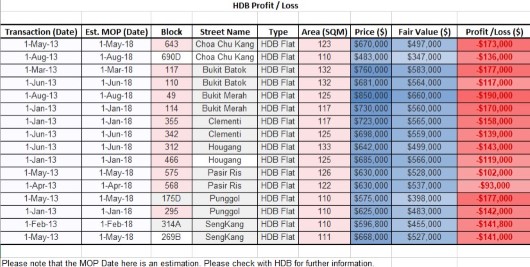

Some of the HDB owners I met were surprised when I told them about the research I did for their current house value.

In some years, some HDB owners could also lose a significant amount of money based on the current estimated market value of their property.

Why Do I Need To Upgrade If I Have Almost Paid Off My HDB In Full?

With all or the majority of your CPF put into your HDB flat...

You do not

* Earn 2.5% interest from leaving it inside CPF

* Accumulate interest of 2.5% on the CPF you utilized

WITHOUT the right CPF usage strategy…

You could be affecting your financial future in the next 5 to 10 years!

Also, reduce your wealth.

* At the end of 5 years, when you sell your HDB , you'll have to return $282,852 to CPF, that is $32,852 less cash from your property sales proceeds.

Your TOTAL LOSS is $65,704!

5 Years

CPF Interest Loss

$32,852

CPF Accrued Interest

$32,852

Your Total Loss

$65,704

10 Years

CPF Interest Loss

$70,021

CPF Accrued Interest

$70,021

Your Total Loss

$140,042

15 Years

CPF Interest Loss

$112,074

CPF Accrued Interest

$112,074

Your Total Loss

$224,148

So how are you able to Break free from this fate?

Arrange a non-obligatory session to know the truth!

Start your life goals journey from here !

Field-Tested Strategies and Action Plans focused on your financial and family situation are needed for a great opportunity.

Also, tailoring Your Ownself unique 5,10,15...year investment plan to allow you to retire comfortably, free from worries with Solid Saving-Plan, and to spend more time to enjoy with your Loved ones.

Seize the OPPORTUNITY................

With my guided Action Plan & proven Asset Progression Strategies…

Indentify the RIGHT and POTENTIAL Asset Investment Plans.

Maintain a HEALTHY amount of RESERVE FUNDs for rainy days!

Create PASSIVE INCOME with minimal to zero extra financial commitment.

Allow Daphne Tan to share her OPTIONS with you

Meet me for a NON-OBLIGATORY discussion & I will share....

- Setting up an efficient Real Estate Investing Road Map for you.

- Securing the Safety Net Financial Power-up Formula

- Evaluating Right and Protected options in the property market and determine the best choice that is suitable for you

As a seasoned property agent since 2006, I recognise and value the trust my clientele places in me and I strive everyday to exceed their expectations. Specialising in resale market residentials and rented properties with a foothold in new launch projects, I can give you a concise overview of the current property market. I take pride in my extensive market knowledge and my unmatched devotion to finding your dream homes. With many years in the field, I am a highly esteemed agent recognised for my extraordinary achievement in (award).

Buying a home in Singapore is a complex, sophisticated and often deeply personal endeavour--but fret not! With my comprehensive knowledge of your needs and wants and your best interests in mind, my clients always win. The right home, suited to your needs for the ultimate quality of life, and all without the legwork of sifting through thousands of properties!

Not only that, I can help you achieve the best potential earnings! My client initially planned to upgrade from a 4-room to a 5-room HDB flat, but with my expertise, they are now proud owners of a brand new Executive Condominium penthouse!

I strive to provide the finest real estate service with true integrity and honesty to all our clients. Your experience with me will be nothing short of outstanding!

YOUR HOUSE SHOULD BE Increasing YOUR WEALTH.

Arrange a completely

FREE and NON-OBLIGATORY

sharing session.

Disclaimer: The case studies are for educational use only and we make no representation or warranties with respect to the accuracy, applicability, or completeness of its contents. Any forward-looking statements outlined in this landing page are simply our opinions, estimates, expectations or forecasts for future potential, and thus are not guarantees or promises for actual performance. As required by law, we can make no guarantees that you will achieve any results.

Results will vary from case to case.

In adherence to the Personal Data Protection Act, by submitting your personal particulars through the forms in this website, you are hereby agreeing to allow us to contact you via the contact information you have provided.

Copyright © 2021 Daphne Tan. All rights reserved.

No part of this site may be reproduced or reused for any other purposes whatsoever without our prior written permission.